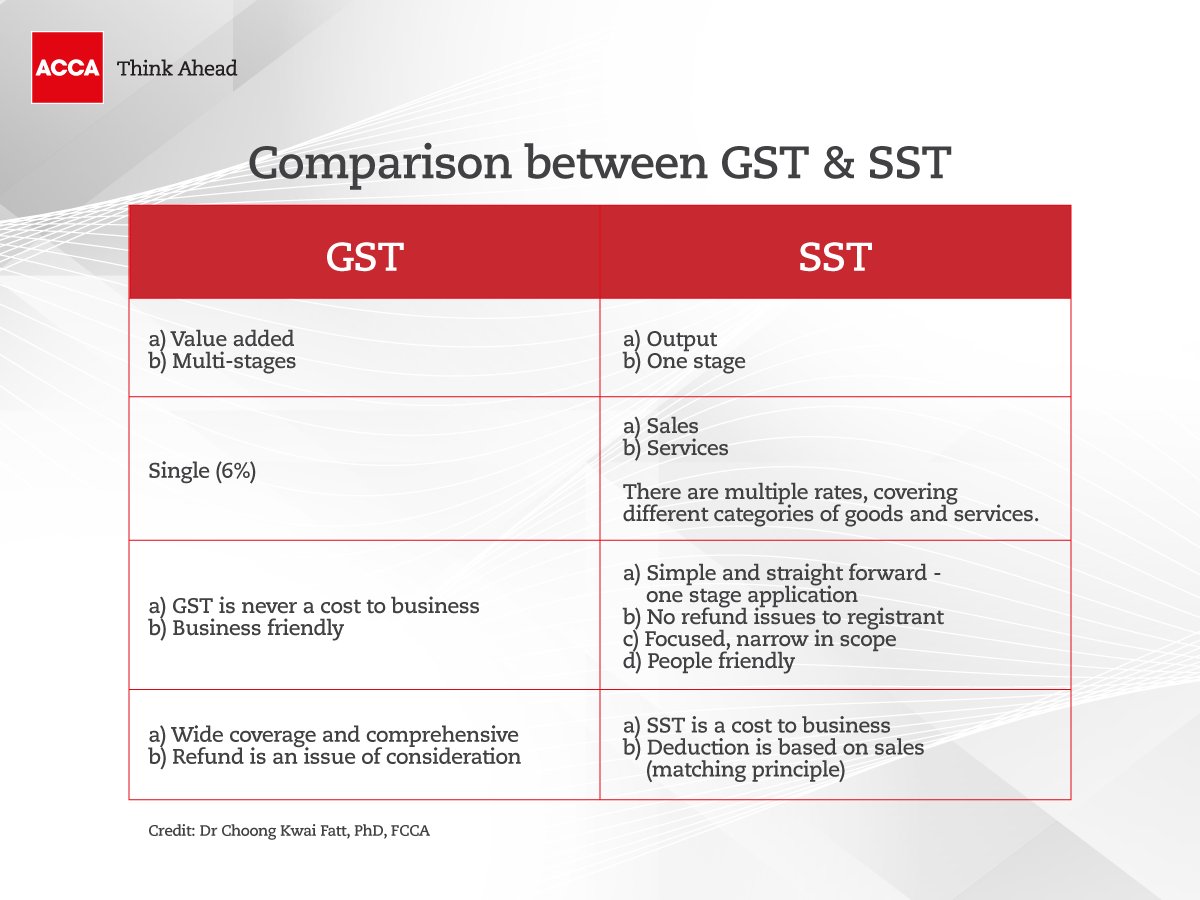

The first reduced SST rate 6 applies to restaurants hotels and accommodation car hire rental and repair domestic flights insurance credit cards legal and. The Goods and Services Tax GST is a value-added tax that was established and implemented on the 1st of April 2015 at a rate of 6.

Sst Vs Gst How Do They Work Expatgo

SST is a federal consumption taxation policy that falls under Sales Tax Act 1972 in Malaysia.

. Supplies made between 1. You need not to be part of any political divide to have an opinion on the Malaysian tax system because any sort of tax system. GST stands for Goods and Services Tax while SST stands for Sales and Service Tax.

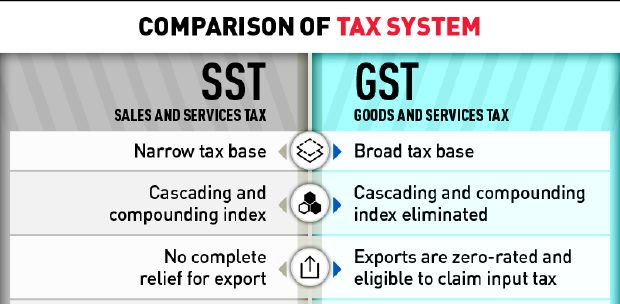

Goods and services tax to sales and service tax transition rules. The standard rate of tax. GST is charged on all taxable supplies of goods and services in Malaysia except those goods and services that are explicitly exempted.

From a laymans perspective VAT can be defined as a charge that is indirectly collected upon the consumption of goods and services by businesses on. The sales tax was at 10 and service tax was at 6 respectively prior to being replaced by GST in. Mandatory registration upon reaching a threshold of RM500000 voluntary registration also possible Sales Tax.

On the 1 June 2018 the new Malaysian government withdrew the Goods and Services Tax GST. Kaygarn No Comments. However not all items are subjected to the 6 rate.

The GST regime has been in place since April 1 2015. The Malaysian government replaced GST with SST as of September 1 2018. The standard goods and services tax GST in Malaysia is sales and service tax SST of 10.

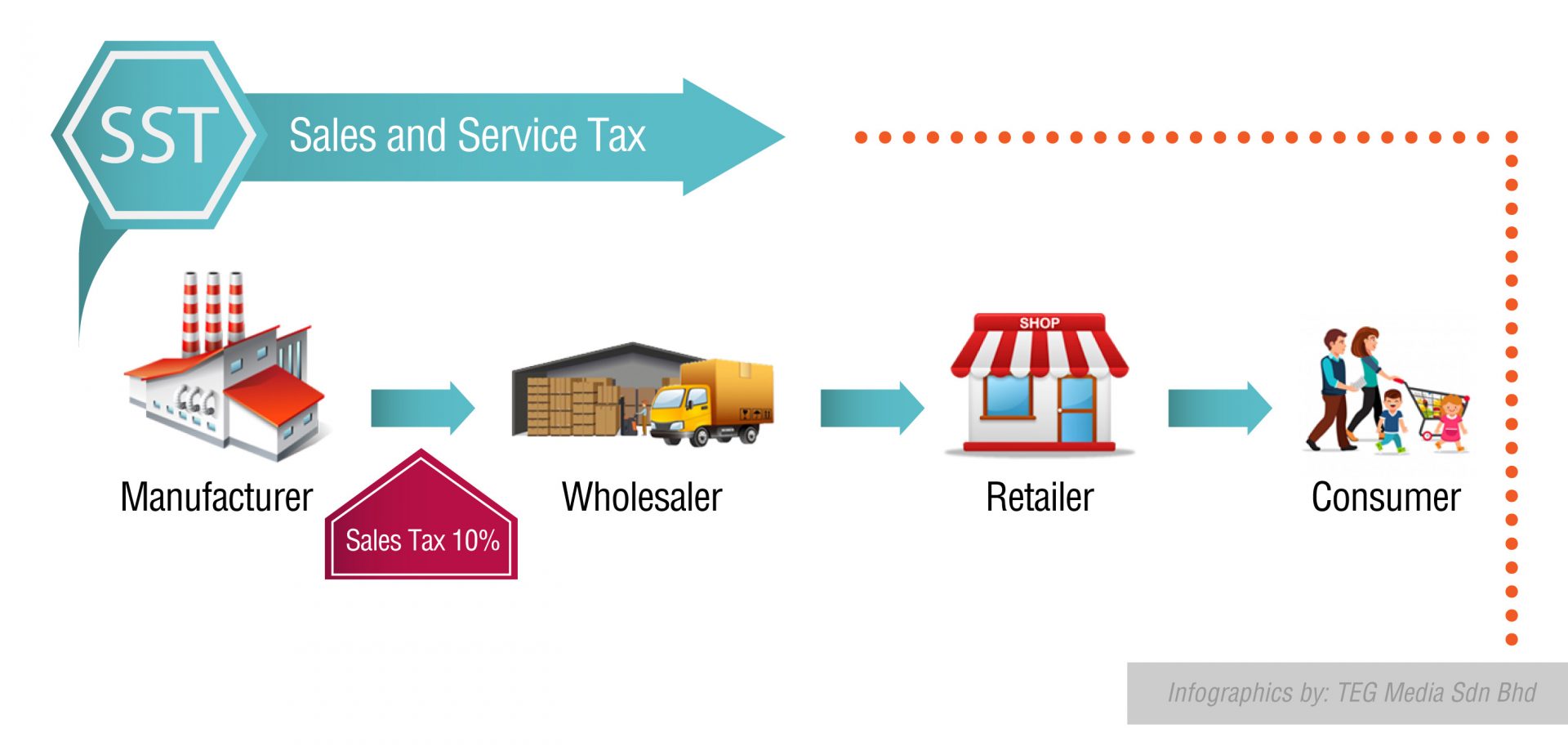

Both taxes are single-stage taxes whereby the sales tax Sales Tax Act 1972 is typically charged at the manufacturers level while the service charge or tax Service Tax Act 1975 is charged at the consumers level except at tax-free zones. Certain supplies are treated as zero-rated exempt or are subject to relief. Up to this day when this post is made people are still arguing and debating about it.

MALAYSIAs decision to revert to the Sales and Service Tax SST from the Goods and Services Tax GST will result in a higher disposable income due to relatively lower prices it will incur in most goods and services. The battle between GST vs SST is real. A license had to be obtained if annual sales turnover exceeded RM100000.

How SST VS GST in Malaysia can be evaluated. It was replaced with a sales and services tax SST on 1 September 2018. Same goes for the GST although obsolete shortly after introduction it is also a taxation policy on most goods and services sold for regular consumptions.

GST is also charged on the importation of goods and services into Malaysia. The two reduced SST rates are 6 and 5. It applies to most goods and services.

Below is a summary of the points for taxpayers to consider during the transition period. Documentary Video Short Research by MS38 -2018-2019. Consumers will have a choice in their consumption by paying service taxes based on their.

Abolition Of Gst And Transition To Sst In Malaysia Activpayroll

Gst To Sst In Malaysia 3 Key Impacts Explained Infographic

Malaysia Sst Sales And Service Tax A Complete Guide

Gst Better Than Sst Say Experts News Summed Up

Malaysia Uncut Sst Vs Gst Best Explaination Malaysiamemilih Malaysiabaru Syukurtomatomasihmurah Facebook

Gst Vs Sst In Malaysia Mypf My

How Is Malaysia Sst Different From Gst

Sst Vs Gst How Do They Work Expatgo

تويتر Accamalaysia على تويتر As We Bid Farewell To Gst And Welcome Back Sst It Is Crucial To Understand The Differences Between These Taxes Learn About The Taxes Today And Seize

Gst What Is Happening To Taxes In Malaysia Gst Vs Sst Treezsoft Blog

Difference Between Sst Gst Sst Vs Gst In Malaysia 2020 Updated

Gst Vs Sst In Malaysia Mypf My

Gst Vs Sst Which Is Better Pressreader

Ey Zero Rating Gst A Good Move To Help With Gradual Transition To Sst Regime The Edge Markets

Sst Vs Gst Do Ph Goverment Do This For The Sake Of Popular And Probably The Only Manifesto Within Their Reach Or Did They Truly Believe Sst Would Reduce Costs Of Living

Sales And Service Tax Sst In Malaysia Transitional From Gst To Sst 2 0

Gst Better Than Sst Say Experts

Difference Between Sst Gst Sst Vs Gst In Malaysia 2020 Updated

Gst Better Than Sst Say Experts